Tokyo-based market research firm Yano has published a new report on Japan’s smartphone game industry.

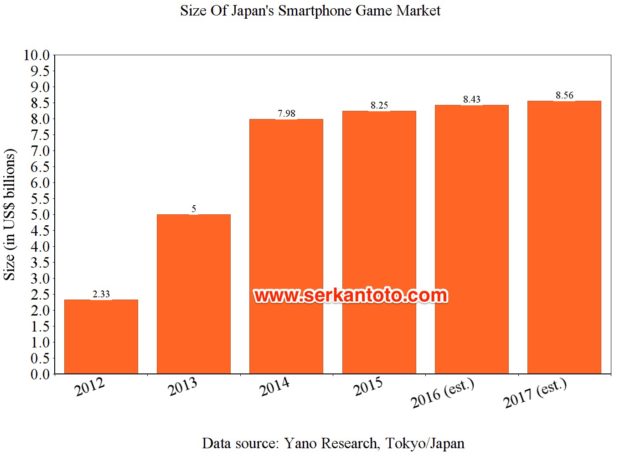

According to the company, the size of the industry is stagnating from 2014 to 2017 within the US$8-8.5 billion band:

The numbers include sales generated inside smartphone native apps as well as browser games. Ad revenue isn’t reflected.

(As mentioned previously on this site, Japan is the only country in the world with a still scaled audience for mobile browser gaming).

Yano’s data is in the same ball park as the one released last summer by Japan’s Mobile Content Forum (MCF) and the Computer Entertainment Supplier’s Association.

By way of comparison: earlier this year, Japan’s biggest video game magazine Famitsu published a report that said the domestic market for video games is sized at US$2.6 billion (hardware and software combined).

In other words, smartphone games are three times bigger than video games in Japan – the only major market that sees this level of dominance of mobile in the world right now.

Yano is selling their analysis on the trend and future of smartphone games in 2017 (in Japanese only) for prices starting at 129,000 yen/US$1,150.

There is one big caveat to their projections (and similar ones from other data providers) in my view: one surprise hit, i.e. one that can expand the number of gamers or generate exceptionally high sales, can change the industry significantly.

Case in point: in South Korea, another mature smartphone game market, the consensus is that the incredible sales performance of Lineage 2 Revolution lifted the industry overall to another level.

(The title roped in hardcore users from the PC as well as people who stopped playing games altogether and became a key driver in publisher Netmarble’s spectacular IPO last month.)