There can be no doubt Japanese companies lead the world when it comes to understanding that free-to-play mobile games are actually services that never end.

As such, live operations are viewed as a key activity in the mobile game industry’s value chain and taken very seriously over here.

For the uninitiated, servicing a given mobile game includes functions such as:

- continuous updates (improvements or new content such as additional levels, etc. on a regular basis)

- analysis and optimization of metrics (retention, monetization, etc.)

- planning and operation of in-game events and collaborations

- ongoing quality control and maintenance

- etc.

The list is simplified, and I am not claiming no Western studio follows this approach, but their Japanese counterparts have been much, much more extreme with regards to live ops for years now.

How extreme?

Japan’s Secondary Market For Mobile Games

There are companies in Japan now that don’t develop but entirely or almost entirely focus on servicing existing games. (The only major example from the West that comes to my mind is San Francisco-based RockYou.)

In Japan, this phenomenon spawned a so-called “Secondary Market” within the mobile gaming industry.

The Secondary Market is also a reflection of the overall consolidation the industry has been seeing recently.

For some Japanese companies, it makes more sense to take over existing games and just try to run them profitably – instead of risking to create games from scratch and release them to compete with literally thousands of other titles.

Mynet Is The Biggest Player In The Secondary Market

The most high-profile company in Japan’s Secondary Market is Tokyo-based Mynet (3928), which went IPO in December 2015.

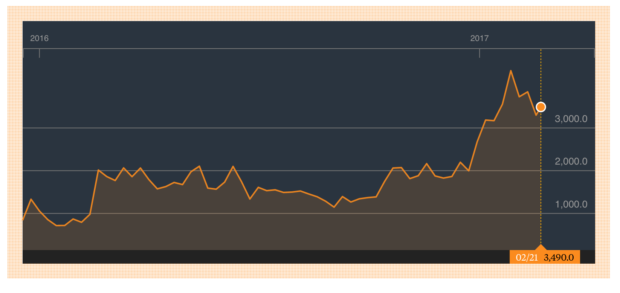

The company currently has a market cap of US$250 million, employs 600 people and saw its stock rising nicely since going public:

Mynet says that in 2016, sales amounted to US$60 million, while profits reached US$5 million.

The plan is to drastically expand this business: in recent months, the company has taken over a number of titles and even entire portfolios from Japanese studios to run on its own. In October 2016, for example, Mynet took over a total of 16 titles from Crooz (2138) in one swoop.

Another example for a major player in Japan’s Secondary Market is funplex, which is sharing an office with its parent company GREE (3632) and whose primary business is operating a total of eight mobile games with 221 people at the moment.

DeNA even went a step further in disintegrating development and live operations by placing its service-focused subsidiary DeNA Games Tokyo in Akihabara, miles away from its HQ in Shibuya ward.

Size Of Japan’s Secondary Market

As a relatively new sub-segment of the overall gaming industry, data to estimate the size of the Secondary Market is generally still hard to come by.

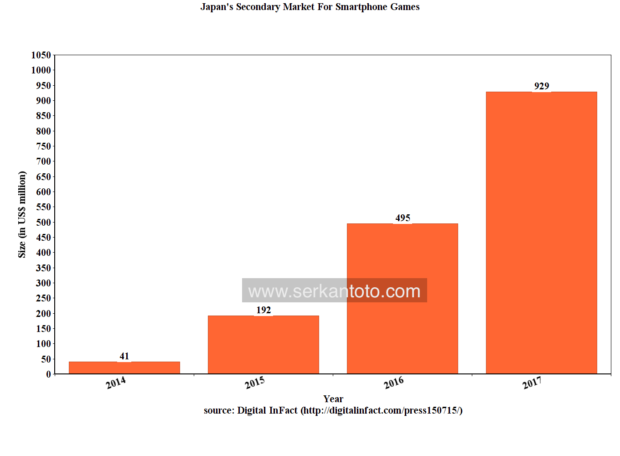

One exception comes from research company Digital InFact, which in July 2015 expected the Secondary Market for smartphone games in Japan to pass 100 billion yen in size this year.

That currently translates to around US$929 million, or about 10% of the overall smartphone game market in Japan:

(currency conversion using dollar-yen rate on Feb. 21, 2017)