CyberZ, a subsidiary of Toky0-based Internet conglomerate CyberAgent (4751), released a report on the size of the Japanese market for smartphone games today.

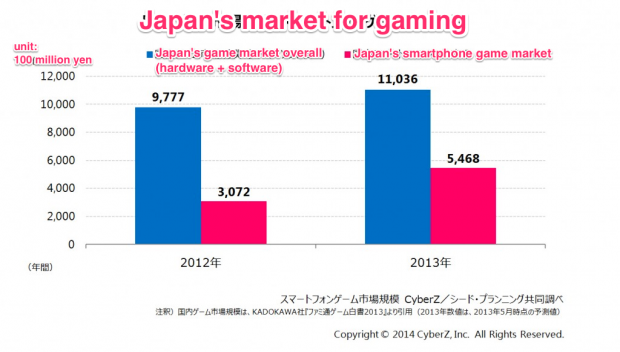

According to the report, the domestic market was worth 546.8 billion yen (US$5.4 billion) in 2013, up from roughly US$3 billion in 2012.

What’s interesting is that this industry now reached roughly 50% of the Japanese gaming industry overall, which is sized at 1103.6 billion yen (US$10.8 billion) in 2013.

Observe how that ratio increased from less than 30% a year earlier:

The reason why CyberZ focuses on smartphones in particular is that Japan is the only country in the world that still has a big feature phone game industry: Japan’s Mobile Content Forum (MCF) last year said that industry by itself was still worth US$2.4 billion in 2012 (see here for details).

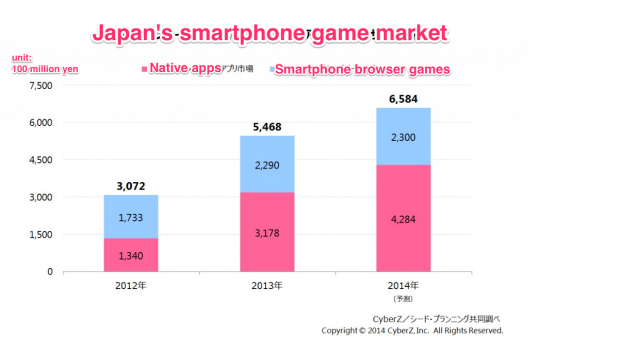

By way of comparison: MCF estimated a size of US$2.7 billion for Japan’s smartphone game market in 2012, while the chart above, at roughly US$3 billion, lands in the same ballpark for that year.

Japan’s Smartphone Game Market Is Poised To Grow Further In 2014

Staying with smartphone games only, CyberZ projects that segment will grow from US$5.4 billion in 2013 to US$6.5 billion this year.

In the chart below, you see the segment broken down to native apps and browser games: apart from feature phone gaming, Japan is also the only country in the world in which millions of people play (and pay for) games inside the smartphone browser (not as apps).

While apps are booming, CyberZ projects the market for mobile browser games in Japan to stay flat year-on-year:

Further Growth For Mobile Games In Japan Projected Through 2016

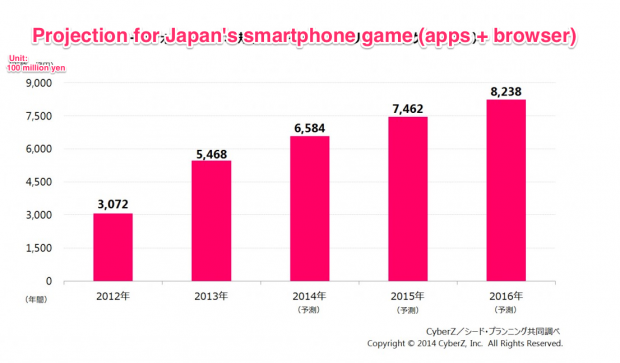

But growth is not to stop in 2014.

According to CyberZ’ s report, Japan’s mobile game makers can expect to see the industry to grow until at least 2016.

As can be seen below, the jumps are getting smaller year over year, but the smartphone game segment is expected to reach 823.8 yen (US$8.1 billion) in size by 2016:

CyberZ conducted the research for the report together with Tokyo-based Seed Planning.